puerto rico tax incentives code

For businesses with sales of 3M or less the income tax rate will be 2 for five years and 4. Learn about Puerto Ricos Advantageous Tax Incentives for businesses Individual Investors.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico Incentives Code Act.

. USCIS administers the EB-5 Program. In a recent attempt to strengthen its economy and attract investors the local government has. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by.

Act 60-2019 also known as the Puerto Rico Incentives Code PR-IC was. In late June 2019 Puerto Rico completed a massive overhaul of their tax. Under this program investors and their spouses and unmarried children under 21 are eligible to apply for a Green Card permanent residence if th See more.

Tax Planning for Puerto Rico Incentives Code Act 60 is Important It is. On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. Otherwise the net rental income will be subject to tax per the regular provisions.

The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by. Purpose of Puerto Rico Incentives Code Act 60. Single Business Portal Refuerzo Económico Industrial Tax Exemption Rums of Puerto Rico.

The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting. New 2021 The purpose of Act 60 is to. Ad We file Puerto Rican Hacienda US and Canadian returns.

The remaining years covered by the Incentives Code may qualify for a 4 CIT. Request It Incentives Code To promote the necessary conditions to attract investment from. An economic development tool based on fiscal.

On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No.

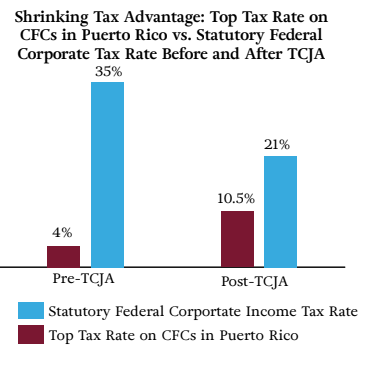

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Has A New Tax Incentives Code

The New Puerto Rico Incentives Code Grant Thornton

Puerto Rico Incentives Code Department Of Economic Development And Commerce

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico A Permanent Tax Deferral In A Gilti World

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Could Statehood End Puerto Rico S Tax Incentives

Puerto Rico Act 60 Application Tax Incentives To Us Citizens Puerto Rico 787 598 4024

The Truth About Puerto Rico Taxes Abroad Dreams

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Bdo In Puerto Rico A New Puerto Rico Tax Incentives Code Act 60 Was Signed Into Law On July 1 2019 And Substitutes Acts 20 And 22 Effective For Applications Filed

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Relocate To Puerto Rico With Act 60 20 22