missouri gas tax increase 2021

Seven other states impose top rates at or below 5 percent. But Myers points out that cap-and-trade legislation passed in 2021 by the legislature and signed into law by Gov.

Governor Signs Legislation To Increase Missouri Gas Tax Lathrop Gpm Consulting

The current tax on motor fuel started at 25 cents in October 2021 and is set to increase 25 cents in each fiscal year until reaching an.

. 712022 6302023 Motor Fuel Tax Rate increases to 022. Mark Kelly D-Ariz who is helping lead the effort. This tax pays for infrastructure projects and mass transportation costs and includes a 01 cent per gallon fee that goes to the leaking underground storage tank trust fund.

The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 77 from 1993 until 2020On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US volume-weighted. Regular Mid-Grade Premium Diesel E85. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows.

The current federal gas tax is about 18 cents per gallon and is used for highway funding. Jay Inslee Senate Bill 5126 or the Climate Commitment Act CCA will have the effect of increasing the gas tax starting next year. Born September 7 1944 is an American businessman investor and philanthropist who has been called an index-fund pioneer for creating the first passively managed index fund open to the general public Sinquefield was also a co-founder of Dimensional Fund AdvisorsHe is active in Missouri politics his two main interests being rolling.

Arizonans are paying some of the highest prices for gas we have seen in years and its putting a strain on families who need to fill up the tank to get to work and school said Sen. Rex Andrew Sinquefield ˈ s ɪ ŋ k f iː l d. On Thursday Myers tweeted In reality their plan relies on a tax on gasoline that starts at 18 cents per gallon in.

The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. North Carolinas 25 percent corporate tax rate is the lowest in the country followed by Missouri 4 percent and North Dakota 431 percent. Florida 4458 percent Colorado 455 percent Arizona 49 percent Utah 495 percent and Kentucky Mississippi and South Carolina 5 percent.

The federal gasoline excise tax was 184 cents per gallon as of 2021. Currently the motor fuel tax rate is 017 per gallon. 1012021 6302022 Motor Fuel Tax Rate increases to 0195.

Illinois Doubled Gas Tax Grows A Little More July 1

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

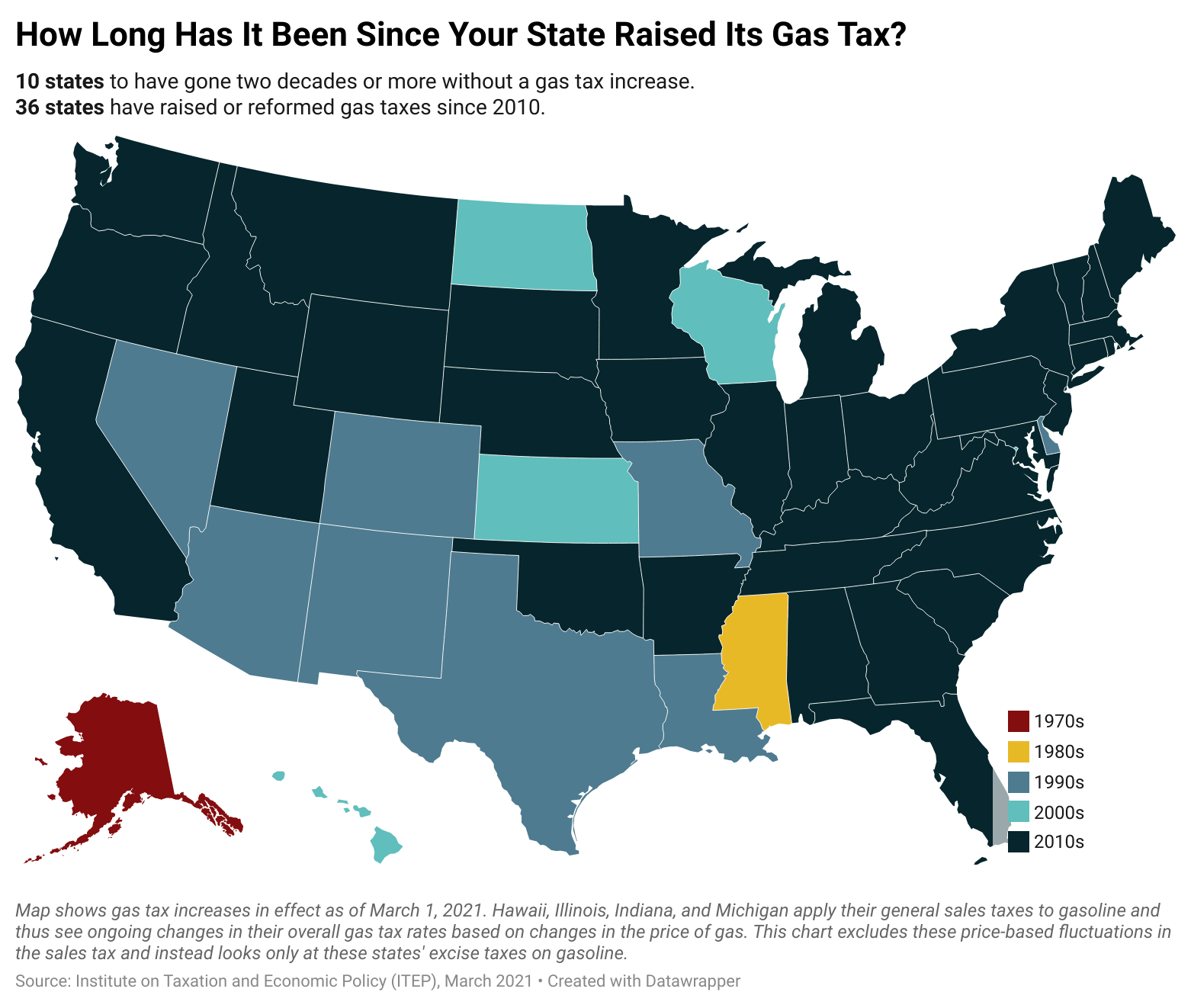

How Long Has It Been Since Your State Raised Its Gas Tax Itep

U S States With Highest Gas Tax 2021 Statista

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Missouri Fuel Tax Increase Goes Into Effect On October 1

How Long Has It Been Since Your State Raised Its Gas Tax Itep